How many times has it happened to you where you thought you were entitled to a certain return on an investment, and it was laced with hidden costs and fees? Whether it is a RRSP, GRC, Mutual Fund or another type of financial initiative, it always seems like there is a hidden cost involved in claiming your investment on your own terms. Insurance policies, at times, can feel the exact same way. Whether it is a deductible that wasn’t properly explained, or a settlement that is reduced by a clause in the contract, it can feel like there is a battle at claim time. Co-Insurance is one of those types of situations in a claim that can also cause frustration and confusion.

Where did Co-Insurance come from, and why do insurance companies enforce such harsh penalties?

The answer stems back to the early 1800’s back in London. Insurance companies back then were trying to understand how to fairly adjust a partial loss where a building had been inadequately valued. For example, there would be an instance of a large barn catching fire, and that fire being put out prior to total destruction of the building. The front half of the barn was almost destroyed with $30,000 worth of damage, while the back half of the barn suffered little to no damage. This presents the question in valuation. If the entire building was worth $100,000, but only got insured for $50,000, which half of the building was the insurance purchased on? The insured would insist that the insurance was purchased on the front half (of course!), and the insurer would insist that the insurance was purchased on the undamaged back half of the building (classic!). This would result in frustrating court processes to determine where the insurance started, and ended.

To rectify this situation, the courts along with the insurance companies came up with a relatively simple system to eliminate these long arguments and questions of insured property. This was called the “Co-Insurance Clause.” They concluded that the insured (policy holder) and the insurer (the company the policy was purchased from) would co-insure the loss. This clause is derived from a notion that the policy holder would take partial responsibility for under insured property on a partial loss, and that the insurance company would also step up, and take partial responsibility.

The solution would save the people, and insurance companies abroad, tons of legal costs, and would go on to reduce insurance premiums as a result.

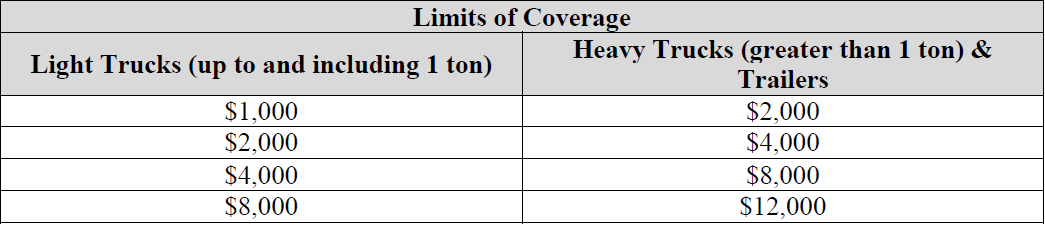

The co-insurance clause is applied to partial losses only, and it encourages policy holders to carry adequate limits of coverage on property. The clause completely revolves around one simple formula to determine the appropriate amount of shared responsibility between a policy holder and insurance company to co insure any type of situation. The formula used for these settlements is as follows:

What did the affected property get insured for? X Amount of the loss = Settlement

What should have the property been insured for?

Using this formula with our previous example on the $100,000 barn; the amount of responsibility shared in the partial loss between the policy holder and the insurance company would be calculated as follows:

$50,000 X $30,000 = $15,000 Settlement

$100,000

This formula ensured that the co-insuring of the partial loss was equally shared between the policy holder and the insurance company in a way that was fair, and easy to calculate.

So here’s the rub

Why suffer a co-insurance penalty? The good news is that there is no reason to. The simple way to avoid these situations is to ensure that you carry proper limits of coverage on your property so that this clause doesn’t even become a factor. Talk to your broker at Block’s Agencies today to ensure that you are carrying adequate limits of coverage for your property. You will sleep better at night knowing that you are adequately insured, and that you don’t have to worry about a nasty co-insurance surprise!