It won’t be long until every other vehicle on the road will be a motorcycle. If it’s not a motorcycle it’s a Spyder, Moped, Electric Cycle, Dual Purpose Dirt bike, Scooter or Trike. There are a lot of benefits to riding a bike: fuel mileage, parking in tight spaces, off-road capabilities and much more. However, there are a lot of risks and things to consider before sitting on a motorcycle. We are going to touch on a bit of what you need to know before your ride and while you ride.

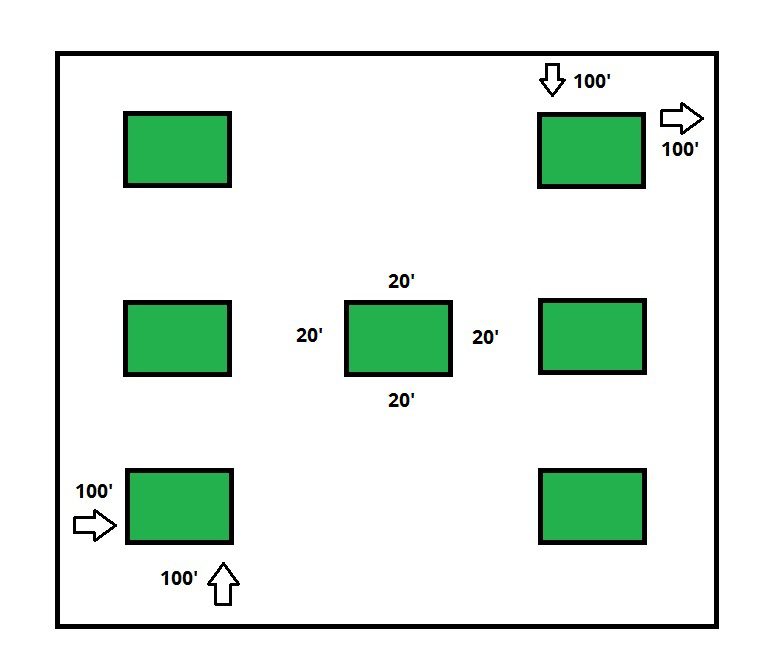

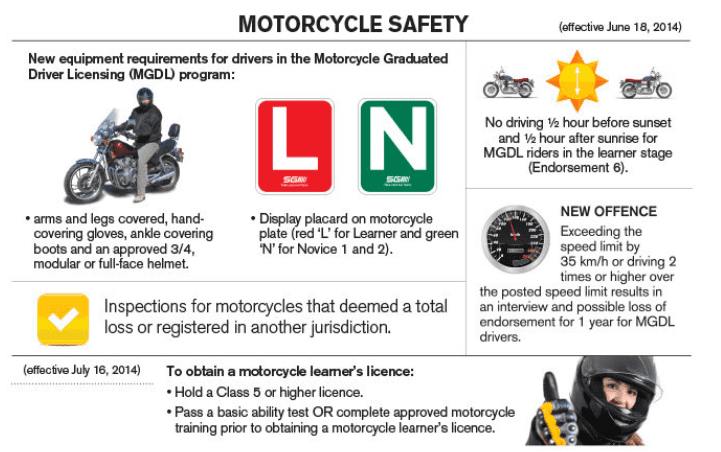

First of all, what is the process to getting a motorcycle license to ride one of these hogs? For first time riders in Saskatchewan, you will need to go through the Motorcycle Graduated Driver Licensing (MGDL) program. This program is a series of written exams and driving tests to help you handle a motorbike correctly. Depending on the size of the bike you use when you take your road test, will decide what size of bike you can operate with your license. These written exams can be taken at any major SGI Driver Exam Office by appointment only.

Once you are licensed and are in the market for purchasing a motorcycle, there are some safety tips you need to be aware of.

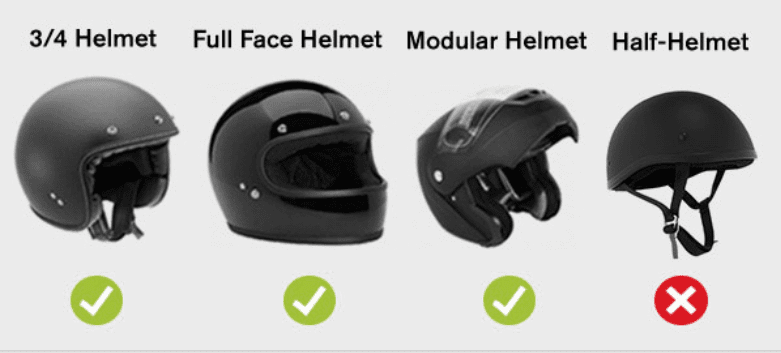

- You must wear a safety compliant helmet

- You must wear protective boots, pants, jacket & gloves

- If you are a graduated driver, look into the restrictions you may have on your license.

- When purchasing a motorcycle, it may need an inspection either from a licensed inspector (if purchased out of province) or an RCMP officer may wish to inspect the unit to confirm the serial number and determine if that unit has ever been stolen.

- Make sure all your signal lights, headlights and brake lights are operational.

- And of course, make sure your motorcycle is registered/permitted before use.

- We recommend adding an extension policy on your motorcycle for additional liability, family security and a reduced deductible.

A notable change that happened last year (2017) is the option to have reduced injury coverage on your motorcycle to reduce the premium on your insurance. The majority of claims costs come from injury benefits that SGI is paying out for motorcycle accidents. Most accidents are very serious or fatal when it comes to operating motorcycles. So opting out of this injury coverage is a serious decision not to be taken lightly. Make sure you understand what you are doing before you opt out of this coverage. If you have a comprehensive disability or injury policy through your work or other avenue, then this may be an option for you. Confirm the coverage extends to motorcycling with your carrier prior to opting out of this coverage. For more information on the “Reduced No-Fault Coverage for Motorcycles.” Visit SGI’s website here or read the booklet here.

There is a sense of power and excitement that comes with riding a motorbike. It is imperative that you take all the precautions you can before and while your riding- that could involve some training on how-to-ride, buying protective gear or purchasing an insurance policy. You need to make sure you are prepared and safe for the road. We want you to enjoy this summer to its full potential, so ride safe and have fun!