Summer in Langham 2018 – July 7th to be exact, will be a storm to remember. How do I remember the date? Well, when you fill in the same form over 300 times with the same date, it turns into “clockwork”. What form was I filling out? A property claim form reporting the hailstorm damage to homes, cars, trailers, and sheds which notifies the insurance company of the losses sustained through the storm.

Hail claims are about as much fun as getting your teeth pulled! You suffer damage to your property, due to a storm you didn’t ask for, you then have the privilege to talk to an adjuster – who may have not had his coffee yet; and in the end, your neighbour John, got his full roof replaced, and you only got one slope done!

Did anyone feel some emotions reading that? When it comes to an insurance claim we set our expectations a certain way. Sometimes we expect no settlement, and other times we expect the world, because that is what our friends or neighbours received. However, emotions can take the logic out of the equation and there are some questions to consider:

Question #1- Are all houses created equal? That’s a big negatory Tomahawk!

Question #2- Are all insurance policies created equal? That is a negative as well.

Question #3 – Are all insurance companies equal? They try! But no, they handle things slightly differently to set themselves apart.

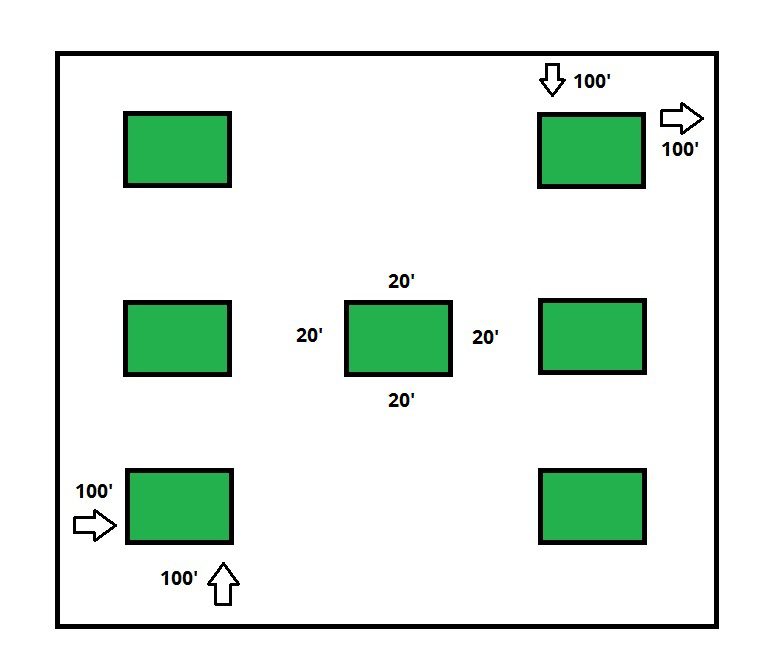

Just like homes, insurance policies are not created, designed or worded the same. Some houses are more elaborate, some have high end components, and some have basic ones. Some are old and some are new. Some homes are big, others small, some short and some quite tall! Now before I turn this into a Dr. Seuss children’s book, I’ll draw the line of comparison.

Insurance products are also quite different from each other, and they all carry different clauses and benefits. While one policy promises to color match and wrap an entire home for partial damages, another will only repair what was actually damaged, even if the colors can’t be matched 100%. Some companies will pay for the replacement cost of your shingles right up to their expiration date, while others only allow replacement cost coverage for the first 15 years, then the coverage changes to the actual cash value from that point forward. Of course, these differences are comparable to the quality, square footage, slope and stories of your home which in the end affects the price tag. If you want the size, the quality and the finish of a luxury home, you will pay for it. Likewise, if you want the luxury of longer replacement cost coverage terms and color matching coverage, it comes at a higher price.

Every item you buy has a corresponding price tag. The better the quality of the home build, the higher the cost. The same coincides with insurance products, and we really can’t expect anything different. The quality of settlement you receive in the event of a claim directly coincides with the coverage you buy. You want the full meal deal you’ve got to pay for it.

The days of a simple “easy-to-read” insurance policy is no longer, and to read the fine print of each one individually is nearly impossible. To find out what type of policy coverage you have purchased or if you have questions, talk to your broker. They will be able to tell you if your policy is the equivalent to a Cathedral Bluffs mansion, or if you are more in the 350 square foot cabin range. Whichever you prefer, it’s important to be informed and to know what you have – that way you can decide to make a change/upgrade or at least it will manage your expectations when the hail hits, and you’ll have a less frustrating time in settling your claim.

Our job is to assess the risks to your home, and then to give you a policy that fits your needs and your budget. Every person has different requirements when it comes to insurance. They need it because the bank says they need it. They want the best coverage because it is the biggest investment of their life. Maybe the person is really handy and can fix most things, so he needs less coverage because he won’t ever put in a claim. Every person/home is different. However, this is just a scenario to show that what you pay for can directly translate into what type of coverage you end up having. Please call us if you want to learn more or would like to make changes to your policy.