On the last article, we discussed how to get your power units and trailers registered with SGI and IRP along with the requirements held by the NSC and Highway Traffic Board. Now that your vehicles are registered, we can discuss on how to properly insure them.

Many commercial vehicles are required to carry a minimum 1,000,000 liability. However, it is not mandatory for all business types. Regardless, we recommend you carry an extension auto liability policy on all your vehicles, whether they are personal or used for business. This is to protect your family and your business from the types of losses that can ruin you financially. The rating on liability is based on the type of risk. If you are a contractor, taxi, ambulance or commercial trucker, your rate will be based on your type of operation.

Liability coverage is the main concern on every policy as this is where the larger losses and claims generally occur. However, there are other damages to your vehicle that can be financially painful as well. You can add endorsements onto your auto policy to protect these types of losses. They include:

- Wildlife deductible waiver

- Reduced Deductible (All Perils)

- Road Hazard Glass

- Loss of Use

- Replacement Cost Coverage

- Excess Value

- Environmental Liability

- Family Security

Wildlife Deductible Waiver

If you have this waiver added onto your commercial auto policy, and you suffer damage to your vehicle by a wild animal (Bird, Deer, Moose, etc.), you will not have to pay your deductible to have the damage repaired.

Reduced Deductible (All Perils)

With your commercial auto policy, you have the option to reduce your deductible from your standard deductible on your registration given to you by SGI or the IRP. Choose a deductible that you will be comfortable with in the event of a loss.

Road Hazard Glass

If you have an expensive windshield or other windows in your vehicle, you may want to add this coverage onto your policy in case you suffer damage to your glass caused by debris or rocks on the road. Depending on the deductible you choose, bruises can be fixed for free and if the windshield needs to be replaced, you pay your glass deductible and get a new windshield.

Loss of Use

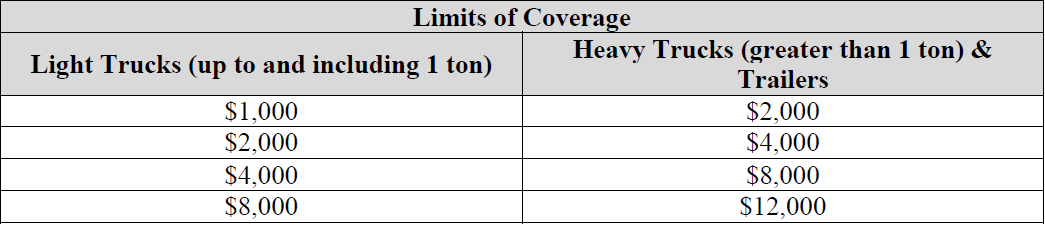

This endorsement allows you to rent a vehicle of similar nature, if your vehicle is unusable during a claim. This coverage is not available for taxis, funeral vehicles, driver trainers and U-drives. Coverage does not respond to mechanical failure. The table of coverage is below:

Replacement Cost Coverage

If you have purchased a new vehicle (cars, suvs, vans and trucks – one ton and less), you will want to purchase this coverage. You have 120 days from the date of purchase to add this coverage onto your vehicle. Coverage runs for a duration of 36 months from that date. What this coverage does is eliminate the depreciation of your vehicle in the event of a total or partial loss. Please give us a call if you would like more information on this coverage.

Excess Value

With large commercial vehicles, SGI will limit the amount of coverage given on your registration. You can add the coverage onto your registration or you can add that value here on your commercial auto policy under the “excess value” endorsement. Every year, you are required to submit an updated list of drivers and vehicles for your commercial auto policy, so we recommend you carry the excess value on the policy so we can review this value annually. What this coverage does is make sure your vehicle is insured for the appropriate value. If your power unit is covered for $15,000 on the registration, but is worth $75,000. You should add the additional $60,000 onto this commercial policy to make sure you are adequately insured. Just remember that if you unlicense your truck to put it in storage, you are removing that $15,000 amount of coverage, so be sure to bump up the value on your commercial auto policy at that time.

Environmental Liability

Where environmentally sensitive commodities are hauled (petroleum, industrial or chemical waste, etc.), the insurance provider may add this endorsement onto your policy which could result in an additional premium to offset the added exposure.

Family Security

Family Security coverage applies when you are involved in an accident with an underinsured or uninsured motorist. If the person who is responsible for the claim does not carry adequate insurance coverage, this endorsement steps up and covers the costs incurred for injuries and damages to the people in your vehicle. Where the coverage is available, Family Security protection will match the third party liability limit to a maximum of $2,000,000.

Commercial Auto policies are quite complicated and require constant attention. Whether it is keeping your vehicle list or driver list updated, or making sure the liability coverage is accurate to your business operation, there will consistently be changes and updates. We are here to help you every step of the way. Please give us a call if you have any questions regarding your commercial auto insurance policy or if you would like more information.